Posted on April 9, 2021

What’s New?

How the American Rescue Plan Health Benefits Will Help Kids

Posted on April 8, 2021

How the American Rescue Plan Health Benefits Will Help Kids

On their own, the health care provisions of the COVID-19 stimulus legislation would create monumental changes to strengthen the current system. Although many of the provisions are directed towards adult health care and insurance, tucked away within these changes are some substantial improvements indirectly affecting children. A full list of provisions in the law can be found on the Georgetown Center for Children and Families website.

For over forty years, ACNJ has advocated for services that support children, as well as the men and women who help them thrive. Though the health care changes detailed in the American Rescue Plan do not directly affect children, they do affect mothers, child care workers and other individuals essential to the healthy development of our infants and toddlers.

While it may be some time before we understand the full effect of some of these changes, especially in light of the shifting economic conditions created by the pandemic and subsequent recovery, some of the positive changes are:

Extension of postpartum coverage from 60 days to 12 months: One huge change will be the new Medicaid and CHIP state option, which would allow states to insure postpartum mothers for 12 months after the child’s birth instead of two months. New Jersey already planned to apply for a waiver to extend six-month postpartum coverage (see NJ’s waiver application here) and planned to fund 365-day postpartum coverage as part of the FY2022 budget, but this policy change would help facilitate it.

ACNJ has advocated for the 12-month postpartum coverage period at the state and federal levels. About 11 percent of New Jersey mothers report experiencing symptoms of postpartum depression, including 12 percent of mothers without insurance. PRAMS surveillance, which monitors the mother’s overall health and attitude as part of a partnership between the Center of Disease Control and state departments, is typically conducted 3-6 months after birth. Losing access to critical medication or medical care when current Medicaid coverage ends 60 days after giving birth can be a serious barrier to appropriate care and support.

Roughly 40 percent of New Jersey births are covered by Medicaid, meaning that extending postpartum coverage to a full year ensures that the new mother will have access to important health resources during this critical period for both mothers and babies.

Marketplace health insurance subsidy increases: Though the increased health insurance subsidies tend to not affect children directly in New Jersey, the increase is extremely important for many of the people who serve infants and toddlers. Child care workers are frequently eligible to buy health insurance on public exchanges because their small-business or non-profit employers do not provide employer-subsidized insurance. In a 2016 national study, only 15 percent of child care workers received health insurance through their employer, compared with 49 percent of all other workers. And these costs effectively cut child care workers’ already-low wages. New Jersey child care workers have a median salary of around $13.37 an hour, compared with the state median for all workers of $23.14 (as of May 2020).

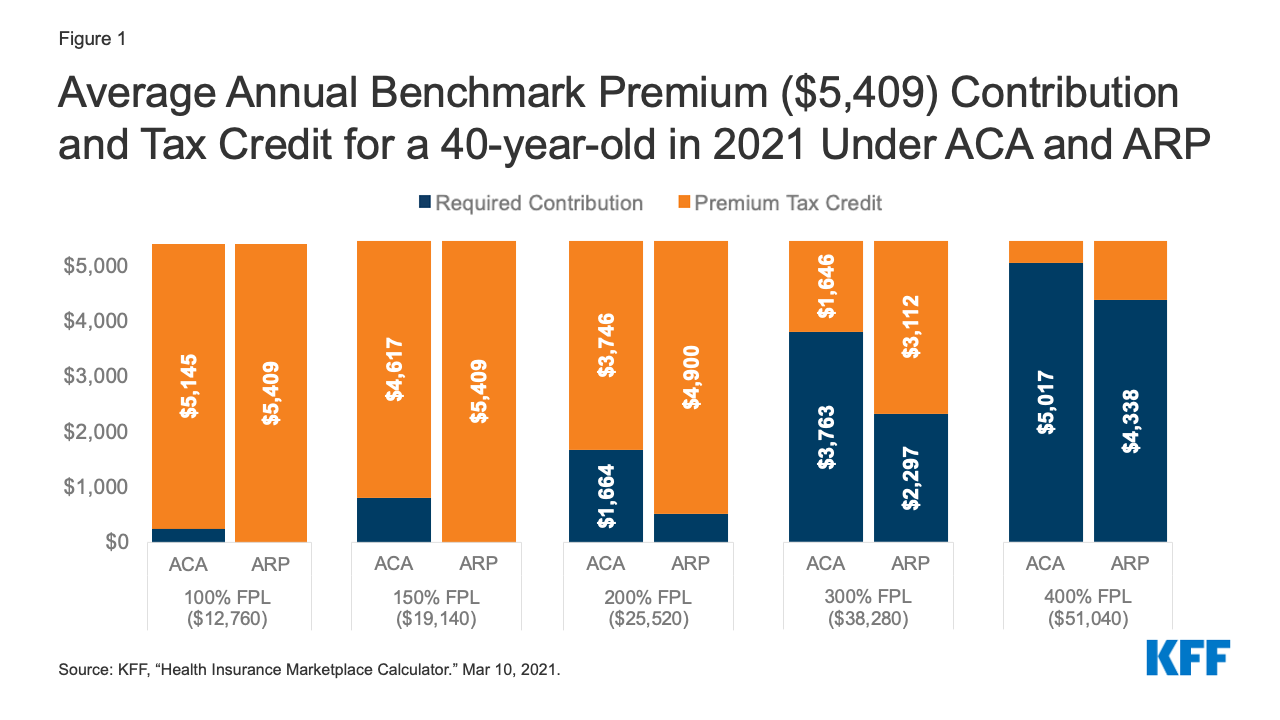

The American Rescue Plan substantially increases the amount of subsidies available to people purchasing insurance on the exchanges, in many cases reducing the premium cost for workers to less than $1,000 annually and in some instances, eliminating the cost entirely. The following chart shows the annual average US benchmark premium rate, with the blue showing the part of the premium the worker has to pay. The amount is dramatically lower for most workers across the board under the new American Rescue Plan (ARP) than under the preexisting Affordable Care Act (ACA).

As an example, a 30-year-old single childless child care worker in New Jersey making $27,740 a year, the state average salary for child care workers, would likely receive around $3,500 in subsidies for health insurance, reducing their health insurance premium costs to $62 per month for a silver plan. To look up other scenarios, the Kaiser Family Foundation has a helpful calculator that incorporates the changes in the stimulus plan.

The big decrease in employee costs for health insurance exchange costs applies to a wide range of workers who work for small employers or independent contractors serving children, including early intervention or developmental disability providers, family child care providers, after-school program staff, etc. These changes make it easier for child care teachers and staff to continue working in this sector caring for children and ensure a healthier workforce.

Those interested in purchasing private health insurance on the New Jersey health insurance exchange should do so at getcovered.NJ.gov during one of the special enrollment periods being offered due to the COVID-19 pandemic.

Medicaid/CHIP coverage of COVID-19 vaccines: Although COVID-19 vaccines are not currently recommended for children under age 16, the American Academy of Pediatrics does recommend the vaccine for currently eligible adolescents and young adults, such as those with high-risk medical conditions and who work in health care or other essential professions. Recently, child care workers and Pre-K - 12 teachers were deemed eligible to receive the vaccine in New Jersey. See who else is currently eligible on the New Jersey state COVID-19 page.

Previous legislation had guaranteed that the federal government would pay for COVID-19 testing for Medicaid/CHIP recipients. The American Rescue Plan now foots the bill for COVID-19 vaccines, as well as requiring that state Medicaid plans cover treatment and prescription medications for COVID-19 complications.

Medicaid FMAP increase for home- and community-based services: The federal government matches state costs for Medicaid through a formula based on Federal Medical Assistance Percentage (FMAP). The American Rescue Plan makes a number of FMAP changes, but one big change for New Jersey is a 10 percent increase for Home- or Community-Based Services.

Although most Home- or Community-Based Services go to residential programs or nursing homes for older adults or adults with disabilities, a small number of children and youth receiving certain intensive health services are paid for through this Medicaid program.

The American Rescue Plan contains a wealth of support for children and their families, allowing an opportunity for their healthy growth and well-being. However, the Plan is only the first step, helping to sustain families through the pandemic, not beyond. We need to raise our voices and continue to help children become successful adults by advocating for appropriate services throughout a child’s development.

Vaccine Appointments Available For Child Care Providers and Educators!

Posted on March 24, 2021

The State has partnered with Walgreens to supply doses of the COVID-19 vaccine to educators. Child care providers and educators can receive the COVID-19 vaccine regardless of the county they live in or work out of.

Registrants will be asked to show their insurance information, but vaccinations will be provided, regardless of insurance status. There is no copay. Second vaccinations will be administered 28 days after the first dose. Below are the appointment locations.

Rite Aid is also prioritizing vaccines for Child Care workers and educators.

The following Walgreen sites have appointments available.

ACNJ Releases Statement Regarding Racism and Hate Shown to Asian Community

Posted on March 26, 2021

We at Advocates for Children of New Jersey are outraged by the senseless acts of violence in our country, most recently to members of the Asian community. The devastation to these families and surrounding communities is overwhelming. Violence, especially when it is the result of hatred and racism, is unacceptable.

At ACNJ, we believe that each child deserves a chance to grow up safe, healthy and educated, allowed to thrive and reach their full potential, regardless of race, ethnicity or background. We know that though the color of one’s skin or life circumstances should not affect how successful our children are, it does. And we as a nonprofit have continued to stand up against systemic inequalities blocking children’s paths to success.

We can start by sharing resources to help educate and inform. Our colleague from Georgia, Mindy Binderman, executive director of GEEARS: Georgia Early Education Alliance for Ready Students, recently shared ways to help children process the impact of these and other traumatic events, including resources developed by Sesame Workshop to help children build resilience and feel safe during tough times. Sesame Street also has informative models that families and early educators can use to help foster positive social and cultural identities. In addition, the Harvard Center on the Developing Child has helpful guidance for parents, policymakers and practitioners.

We can stand up to hate is by spreading information. ACNJ is sharing these resources with you, and ask that you do the same and spread the word within your network.

To achieve our goal of a more equitable future for all, we ask that you join us in speaking out against hate and violence. Our children are looking to us to create a brighter future for them, one where they have the supports necessary for their healthy development. And in order to do this, we need to take steps in denouncing racism and hate so that everyone has a chance to thrive.

ACNJ Testimony on Proposed State FY2022 Budget

Posted on March 23, 2021

The Governor’s commitment to a fair and equitable State recovery from the COVID-19 pandemic, especially for children and families is reflected in his proposed FY2022 budget. Much-needed additional funding for such programs for schools, public health, school aid, child care, and tax assistance for families will help to minimize the impact of the pandemic now and in the months ahead while providing funding to ensure that the needed systems are in-place to support our state’s economic recovery.

The proposed funding commitments to our youngest children is encouraging, specifically in preschool expansion, child care, home visitation, child dependent tax credit, and supports to Nurture NJ.

As we begin the second year of the pandemic, critical systems that support children, families and our state economy have been and continue to be in crisis. One of those systems that remains in peril is child care. The following testimony includes recommendations that ACNJ believes are critical in ensuring that the economy, working families and children can benefit from a stronger, more stable child care system.