Posted on April 21, 2022

It's time to address the long-time child care crisis in New Jersey. The pandemic didn’t create it – it exposed it.

Let's urge legislators to support Senate Majority Leader Teresa Ruiz's comprehensive package of bills that would help parents, strengthen programs and support staff. One bill, S-2476 (pending introduction), incentivizes the development of child care for infants and toddlers, the most difficult for families to find.

Share the op-ed authored by ACNJ President Cecilia Zalkind describing this historic proposal.

The package comes with a $360 million price tag. But we need to tell state leaders that this is an investment we cannot afford not to make.

New Jersey's commitment to children has led to extraordinary advances, putting the state ahead of the rest of the country and most importantly, improving the lives and well-being of newborns and preschool-age children.

But we are still missing the babies.

Let's make some noise for child care and take a moment to send a message to your state leaders that this is a critical investment for children, families and for our economy.

During this legislative session, ACNJ is calling on the state to:

- Improve access to infant/toddler care by increasing the number of available child care programs;

- Expand child care assistance for parents of very young children; and

- Support the child care workforce, who have historically been underfunded and underappreciated

In order to give all children a strong and equitable start in life, New Jersey must begin with an intentional focus on eliminating racial inequities and disparities in access to essential supports, according to a new report,

In order to give all children a strong and equitable start in life, New Jersey must begin with an intentional focus on eliminating racial inequities and disparities in access to essential supports, according to a new report,

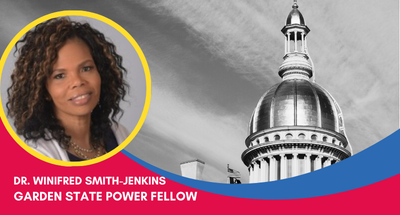

Please join us in celebrating Dr. Winifred Smith-Jenkins, ACNJ’s Director of Early Childhood Policy and Advocacy, who has been selected for the Garden State Power Fellowship. She is one of 24 chosen for this opportunity. Supported by the Robert Wood Johnson Foundation, the Fund for New Jersey, and the Rockwood Leadership Institute, this fellowship is designed to grow the leadership development infrastructure in New Jersey for senior leaders in state-wide policy organizations, provide leaders a transformational opportunity to grow their leadership, mitigate burnout and enhance sustainability, and strengthen networks and connects with other leaders in the region.

Please join us in celebrating Dr. Winifred Smith-Jenkins, ACNJ’s Director of Early Childhood Policy and Advocacy, who has been selected for the Garden State Power Fellowship. She is one of 24 chosen for this opportunity. Supported by the Robert Wood Johnson Foundation, the Fund for New Jersey, and the Rockwood Leadership Institute, this fellowship is designed to grow the leadership development infrastructure in New Jersey for senior leaders in state-wide policy organizations, provide leaders a transformational opportunity to grow their leadership, mitigate burnout and enhance sustainability, and strengthen networks and connects with other leaders in the region.