Posted on September 30, 2025

What’s New?

The Impact of Social Media on Adolescents

Posted on September 22, 2025

ACNJ served on New Jersey’s Commission on the Effects of Social Media Usage on Adolescents, which examined how social media impacts young people. The Commission published recommendations aimed at preserving social media’s benefits while reducing potential harms – including banning cellphones at school and delaying social media access until age 16.

More in the News:

- NJ Spotlight Article: Banning cell phones in NJ schools? Here’s what to know

- Eyewitness News: NJ Commission Releases Recommendations on Social Media Usage for Adolescents

- News 12 On Air Story: NJ Commission Suggests Bell-to-Bell Cellphone Bans for All School Districts

- WHYY: New Jersey Students Could Soon Face a “Bell-to-Bell” Cell Phone Ban in Schools

- NJ.com: NJ Schools Need Stricter “Bell-to-Bell” Cell Phone Bans, State Commission Says

- Bergen Record: NJ Commission Recommends “Bell-to-bell’ Cell Phone Ban in Schools But Bill Stalls

How CenteringPregnancy® Improves Outcomes for Parents and Babies in New Jersey

Posted on October 6, 2025

Manager, Health Policy

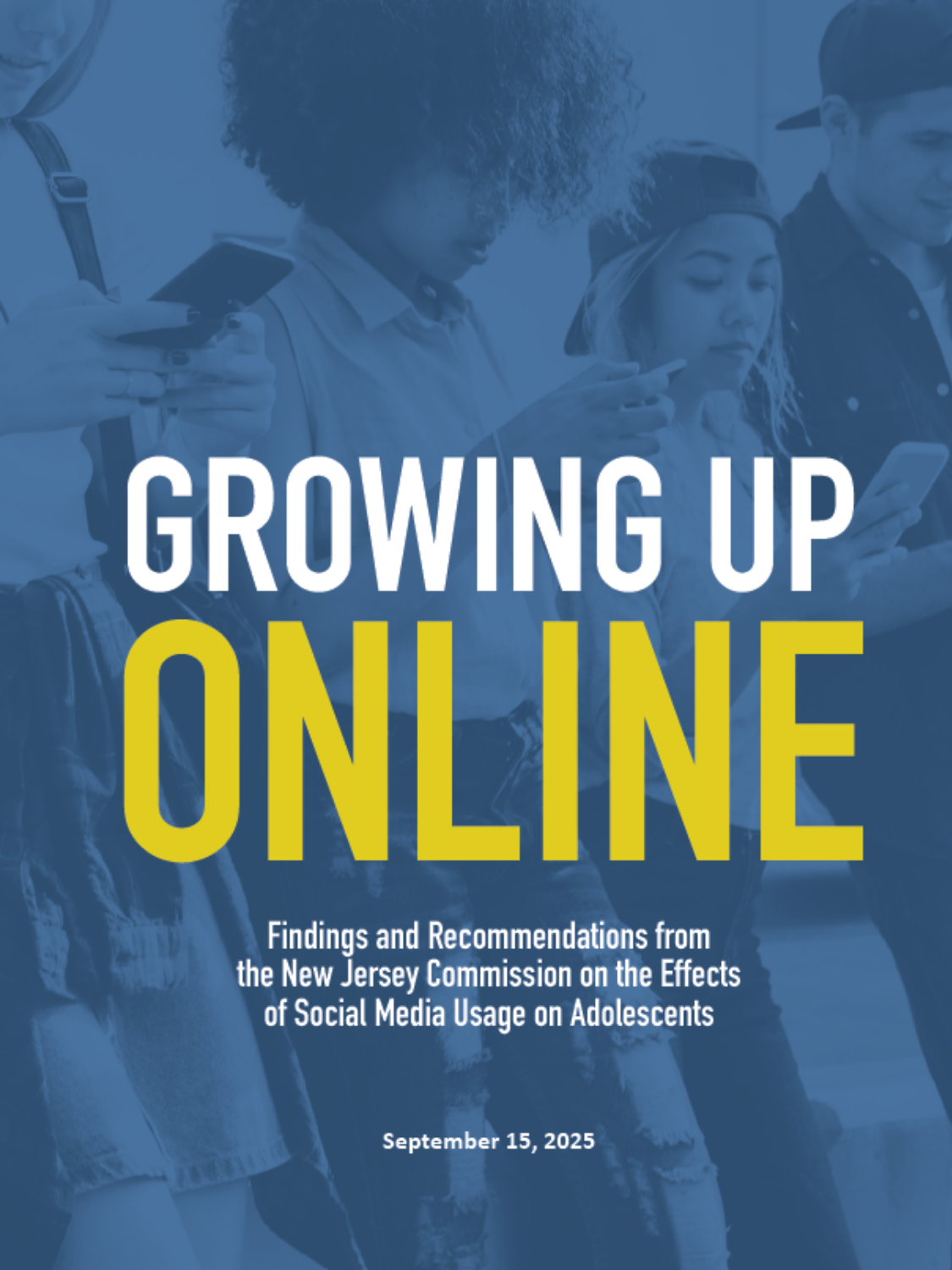

Patient-centered care prioritizes the needs of each individual. One powerful example is group prenatal care, such as CenteringPregnancy®, which has been shown to lower the risk of preterm birth, low birthweight and NICU stays. In New Jersey, we need to build greater awareness of group prenatal care and update policies to ensure all birthing people receive the high-quality care they deserve.

What is Centering?

Centering Healthcare Institute is a non-profit organization that works closely with health care providers from all sectors to transform healthcare delivery, especially regarding improving outcomes related to mothers, babies and families. With over three decades of experience as the go-to resource for group care, we have developed and sustained the evidence-based Centering model of care in nearly 500 practice sites and in some of the largest health systems in the world.

Let's make children and their

families the center of the

2025 Election Campaign.

-

-

-

- Facilitated, group-based medical appointments consisting of:

-

- Health assessments

- Interactive learning

- Community building

-

- Higher rates of patient satisfaction, preparation for labor and delivery

- Improved attendance at visits and stress reduction

- Patients have the opportunity to be heard

- Providers have a chance to listen and evaluate patient needs

- Reduction in racial and socioeconomic disparities in birth outcomes

- Facilitated, group-based medical appointments consisting of:

-

-

Evidence

With over 200 peer-reviewed studies, Centering:

- Reduces the risk of preterm birth by 33-47%, with further reduced risk for Black pregnant people

- Increases breastfeeding initiation

- Increases likelihood of LARCs (Long-Acting Reversible Contraception) use by 70%

- Reduces the risk of NICU admissions by 37%

- Reduces emergency room utilization

Centering in New Jersey

-

-

-

- 24 CenteringPregnancy sites, over 500 patients served

- More than 1 in 4 pregnant patients at NJ CenteringPregnancy sites received care through CenteringPregnancy

- 2023 Data:

-

-

| Centering | New Jersey | |

| Preterm Birth | 9.9% | 11.3% |

| Low Birth Weight | 6.8% | 7.98% |

CHI’s Policy Recommendations

-

-

-

- Increase the enhanced reimbursement rate for group prenatal care from $7 to $45 per patient per session

- Include coverage for federally qualified health centers (FQHCs) in amended policy as FQHCs serve underserved populations, reduce barriers to care, improve birth outcomes, reduce health disparities and support financial sustainability

-

-

Why an Increase for Enhanced Reimbursement is Beneficial for NJ

-

-

-

- Targets disparities

-

-

-

-

-

-

-

- With the support and education that group prenatal care provides, it allows both patient and providers to address social determinants of health

-

-

-

-

-

-

-

- Cost Savings for Medicaid

-

-

-

-

-

-

-

- Almost half of the births being financed by Medicaid, meaning the outcomes that Centering has proven to have can translate to cost savings for Medicaid

- Enhanced reimbursement also helps providers cover the extra time, staffing and materials needed

-

-

-

-

-

-

-

- Alignment with Existing Initiatives

-

-

-

-

-

-

-

- New Jersey has made significant strides in improving maternal and child health outcomes and increasing the reimbursement for group prenatal care would continue with this broader strategy.

-

-

-

-

Call to Action

-

-

-

- Invest in long-term cost savings

- Improve maternal and child health outcomes by recognizing CenteringPregnancy as patient-centered care and closing gaps in maternal morbidity and mortality

-

-

To learn more about our models of care, expand Centering in New Jersey, and influence policy, partner with the Centering Healthcare Institute.

Your Rights to Attend School in New Jersey: A Simple Guide

Posted on September 25, 2025

Co-Authored by:

Catherine Thompson, Senior Corporate Counsel, Audible

Rachel Wiltshire Associate Corporate Counsel, Audible

For more information on this topic, contact Nina Peckman at npeckman@acnj.org.

Who Can Attend School?

Students ages 5-20 (ages 3-21 if in special education)

Where You Can Attend School

You can attend school in a district if:

- Your parent/guardian lives there

- You live with someone who takes care of you like a parent (without payment)

- You're temporarily staying in the district due to family hardship

- You live with someone who resides in the district when your parent/guardian are active military members in certain situations

- You're homeless

- You're placed there by court order

Important Protections

- You Cannot Be Denied Enrollment Because:

- Your housing isn't in perfect condition

- You don't have a birth certificate (you have 30 days to provide it)

- You don't have medical records (but may need immunizations to attend)

- You don’t have the records from your previous school district

- Of your immigration status

- The School Cannot Require:

- Income tax returns

- Social Security numbers

- Immigration documents

- Housing inspection reports

Steps to Enroll

- Fill out the school's registration forms

- Provide proof you live in the district (can include):

- Lease or mortgage documents

- Utility bills

- Property tax bills

- Voter registration

- Other documents showing where you live

- Once the school receives proof of residency and immunization (unless an exception to immunization requirements applies), a student must be allowed to attend even if the other required records are not yet available.

If You're Denied Enrollment

Your Rights:

- The school must give you written notice explaining why

- You have 21 days to appeal

- Your child can attend school during those 21 days

- You can continue attending while appealing

How to Appeal:

- File an appeal with the Commissioner of Education

- Get help from the school district's designated administrator

- You have the right to a hearing in certain cases

Special Situations

- Family Crisis Protection:

- Students can stay in their original school if they move due to:

- Domestic violence

- Death of a parent/guardian

- House becoming uninhabitable (fire, flood, etc.)

- Other family hardships

- Homeless Students:

- Have special enrollment rights

- Should contact the district's homeless liaison

- Cannot be denied enrollment due to lack of documents

Need Help?

- Each school district must have a designated administrator to help with enrollment

- All notices must be in English and your native language

- Free legal help is available through ACNJ and other education advocacy organizations.

Remember: These rights apply to ALL students, regardless of their immigration status or housing situation. If you need help, ask to speak with the school district's designated enrollment administrator.

When a parent should contact an attorney

Based on the provided information, you would most likely need to contact an attorney in these specific situations:

- If your child is denied enrollment and you need to appeal the decision, especially if you believe the denial was incorrect or unfair.

- If you have a complex custody situation, such as:

- Shared custody between parents living in different districts

- Recent changes in guardianship

- Need to prove legal guardianship status

- Custody disputes that affect where the child can be enrolled

- If your child is living in a non-traditional arrangement that might need legal documentation, such as:

- Living with someone who isn't the parent/legal guardian

- Need to establish an "affidavit student" status (where someone other than a parent is caring for the student)

- Complex living situations that might affect residency status

- If you're asked to pay tuition after initial enrollment because the district later determines your child wasn't eligible to attend (you might want legal advice to challenge this)

- If you believe the school district is requesting documentation they're not legally allowed to require (like immigration status or income tax returns)

Remember: Most routine enrollments don't require an attorney. It's primarily when there are disputes, complex custody situations, or appeals that legal assistance becomes helpful.

Links to relevant law

Links to helpful resources

- New Jersey Department of Education official site “Attendance at School Based on Domicile or Residency in the School District”: https://www.nj.gov/education/residency/

- Education Law Center:

- More detailed information for advocates, see: https://edlawcenter.org/wp-content/uploads/2024/10/Residency-Publication-2024-Update-10.03.24-Final-with-appendix.pdf

Addressing Achievement Gaps in New Jersey Education: A Parent’s Guide

Posted on September 25, 2025

Co-Authored by:

Patrick O'Keefe

Contracts Manager

Audible

Ryan Whittington

Manager, Public Policy

Audible

For more information on this topic, contact Nina Peckman at npeckman@acnj.org.

New Jersey education law establishes a comprehensive framework to address achievement gaps and ensure educational equity. The law mandates specific protections and support systems, particularly for students from disadvantaged backgrounds, those with disabilities, and English language learners. Key legal provisions include the right to intervention services (I&RS), special education evaluations, and appropriate educational accommodations. The 2023-2024 data shows persistent achievement gaps, triggering additional legal protections under P.L. 2024, c.053, which created the Office of Learning Equity and Academic Recovery (LEAR) to specifically address these disparities.

Parents have legally protected rights to request evaluations, participate in educational planning, and appeal school decisions. Schools must respond to evaluation requests within 20 days and complete evaluations within 90 days if approved. The law requires schools to provide appropriate interventions through a tiered support system before considering special education services, unless immediate evaluation is clearly warranted.

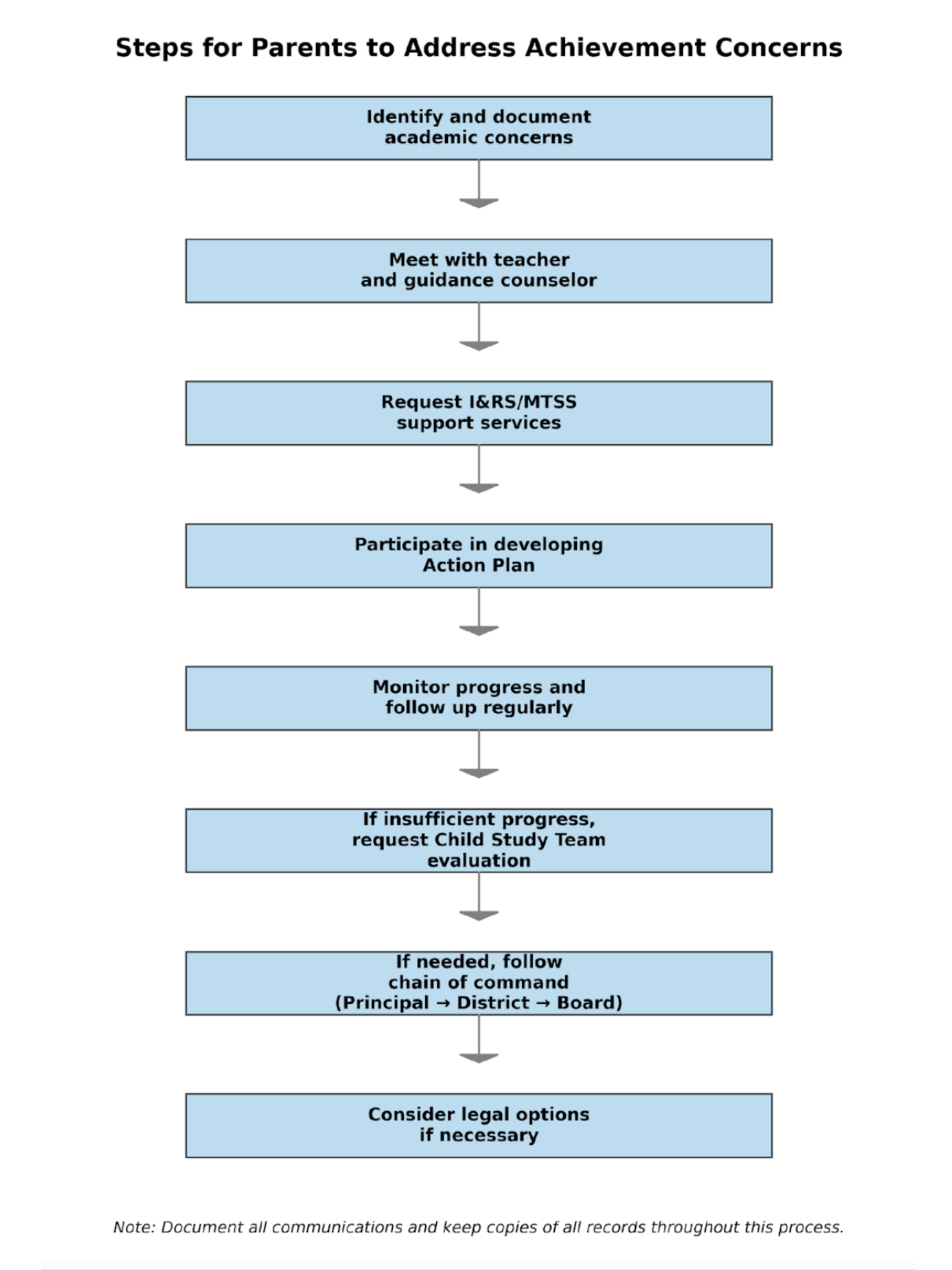

Steps Parents Should Take to Ensure the Law is Enforced

When parents are concerned about their child’s academic progress, they should follow a structured approach to ensure their child receives appropriate support under New Jersey education law. The following steps outline the process parents should follow:

- Document Academic Concerns

-

-

-

-

- Collect dated samples of schoolwork

- Keep records of grades and test scores

- Document all communications with school staff

- Compare performance to grade-level standards

-

-

-

- Request Initial Intervention

-

-

-

-

- Submit written request for I&RS meeting to principal

- Attend I&RS meeting and participate in action plan development

- Request progress monitoring schedule

- Get copy of intervention plan in writing

-

-

-

- Monitor Intervention Effectiveness

-

-

-

-

- Track implementation of agreed interventions

- Request regular progress updates

- Document any gaps between plan and implementation

- Request plan modifications if progress is insufficient

-

-

-

- Request Formal Evaluation (if needed)

-

-

-

-

- Submit written evaluation request to Child Study Team

- Attend evaluation planning meeting within 20 days

- Provide written consent for approved evaluations

- Monitor 90-day evaluation timeline

-

-

-

- Exercise Due Process Rights (For Special Education)

-

-

-

-

- Request State Mediation or file a Due Process Petition for unresolved disputes

- File a Complaint Investigation for legal violations

- Appeal unfavorable decisions within prescribed timeframes

- Document all steps taken to resolve issues

-

-

-

Consult an education attorney when:

- School fails to meet mandatory timelines:

- No response to evaluation request within 20 days

- Evaluation exceeds 90-day completion deadline

- IEP services delayed without explanation

- Serious procedural violations occur:

- Denial of appropriate evaluations

- Implementation failure of IEP/504 services

- Exclusion from educational decision-making

- Unauthorized service/placement changes

- Discrimination or systemic issues:

- Pattern of unequal treatment

- Denial of appropriate accommodations

- Bullying/harassment not properly addressed

- Complex disputes requiring legal expertise:

- Due process hearings

- Mediation proceedings

- Settlement negotiations

- Disciplinary actions affecting placement

NJ Law

- Relevant Education Regulations and Statutes include:

- N.J.A.C. 6A:14 (Special Education)

- N.J.A.C. 6A:16-8 (Intervention and Referral Services)

- N.J.A.C. 6A:8 (Standards and Assessments)

- N.J.A.C. 6A:12 (School Choice Programs)

- N.J.A.C. 6A:15 (Bilingual Education)

- N.J.A.C. 6A:7 (Managing for Equality)

- N.J.S.A. 18A

- P.L. 2024, c.053 (LEAR Act)

- Federal Laws Applicable in NJ

- IDEA (20 U.S.C. § 1400)

- Section 504 (29 U.S.C. § 794)

- Americans with Disabilities Act (42 U.S.C. § 12131)

- ESSA (20 U.S.C. § 6301)

Helpful Resources

- Government Resources

- NJ Department of Education Special Education: https://www.nj.gov/education/specialed/

- LEAR Office: https://www.nj.gov/education/lear/

- NJ Parent Rights: https://www.nj.gov/education/specialed/form/prise/

- Legal Assistance

- Education Law Center: https://edlawcenter.org/

- Legal Services of NJ: https://lsnjlaw.org/education

- Disability Rights NJ: https://www.drnj.org/

- Parent Support and Advocacy Organizations

- SPAN Parent Advocacy: https://spanadvocacy.org/

- NJ Special Education Parent Advisory Groups (SEPAG): Contact local district

- Additional Resources

- Special Education Ombudsman: specedombudsman@doe.nj.gov

- NJ Family Support Organizations: https://www.nj.gov/dcf/families/support/

- County Education Offices: https://www.nj.gov/education/counties/

Common Legal and Educational Terms:

Federal Laws:

- IDEA: Individuals with Disabilities Education Act

- ESSA: Every Student Succeeds Act

- IEP: Individualized Education Program

- FAPE: Free Appropriate Public Education

- LRE: Least Restrictive Environment

New Jersey State Terms:

- NJDOE: New Jersey Department of Education

- N.J.A.C.: New Jersey Administrative Code

- N.J.S.A.: New Jersey Statutes Annotated

- PRISE: Parental Rights in Special Education (a booklet)

- P.L.: Public Law

- LEAR: Learning Equity and Academic Recovery Office

- DCF: Department of Children and Families

- DCP&P: Division of Child Protection and Permanency (Part of DCF)

- CSOC: Children’s System of Care (Part of DCF for behavioral health services)

School-Based Support Services:

- MTSS: Multi-Tiered System of Support

- I&RS: Intervention and Referral Services

- CST: Child Study Team

- IEP: Individualized Education Program

- 504 Plan: Accommodation plan under Section 504 of the Rehabilitation Act