Posted on June 21, 2021

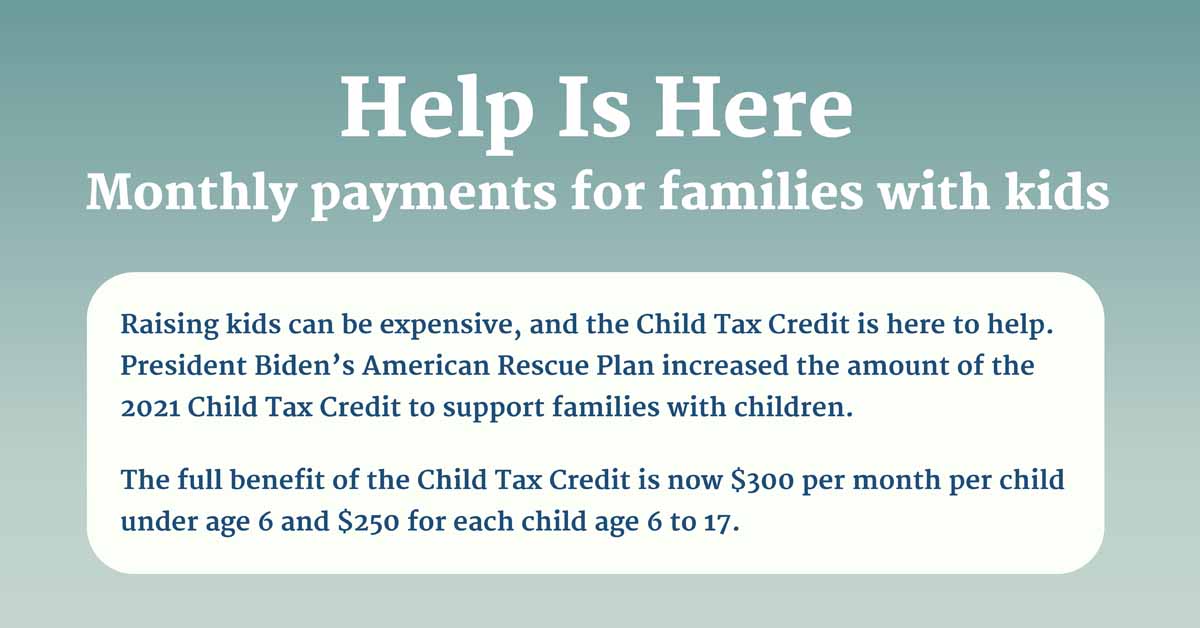

Beginning July 15, nearly all families who have filed their tax returns will begin receiving child tax credit (CTC) payments. They will receive one per month. For each of their qualifying children age 5 or younger, most parents will receive $300 per month in July, August, September, October, November and December for a total of $1,800. For each of their qualifying children ages 6 to 17, most parents will receive $250 each month for a total of $1,500.

The payments should appear in your bank account automatically. However, because the IRS relies on tax returns to determine the eligibility, some people may fall through the cracks, such as low-income households that did not have to file tax returns. There’s a special website for parents and caregivers who are eligible, but who did not file taxes last year. It’s called the Non-filer Sign-up Tool.